Condo Insurance in and around Bear

Looking for outstanding condo unitowners insurance in Bear?

Insure your condo with State Farm today

Your Search For Condo Insurance Ends With State Farm

Being a condo owner isn't always easy. You want to make sure your condo and personal property in it are protected in the event of some unexpected damage or catastrophe. And you also want to be sure you have liability coverage in case someone stumbles and falls on your property.

Looking for outstanding condo unitowners insurance in Bear?

Insure your condo with State Farm today

Protect Your Condo With Insurance From State Farm

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Rob Mullen is ready to help you prepare for potential mishaps with reliable coverage for all your condo insurance needs. Such attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If you have problems at home, Rob Mullen can help you submit your claim. Keep your condo sweet condo with State Farm!

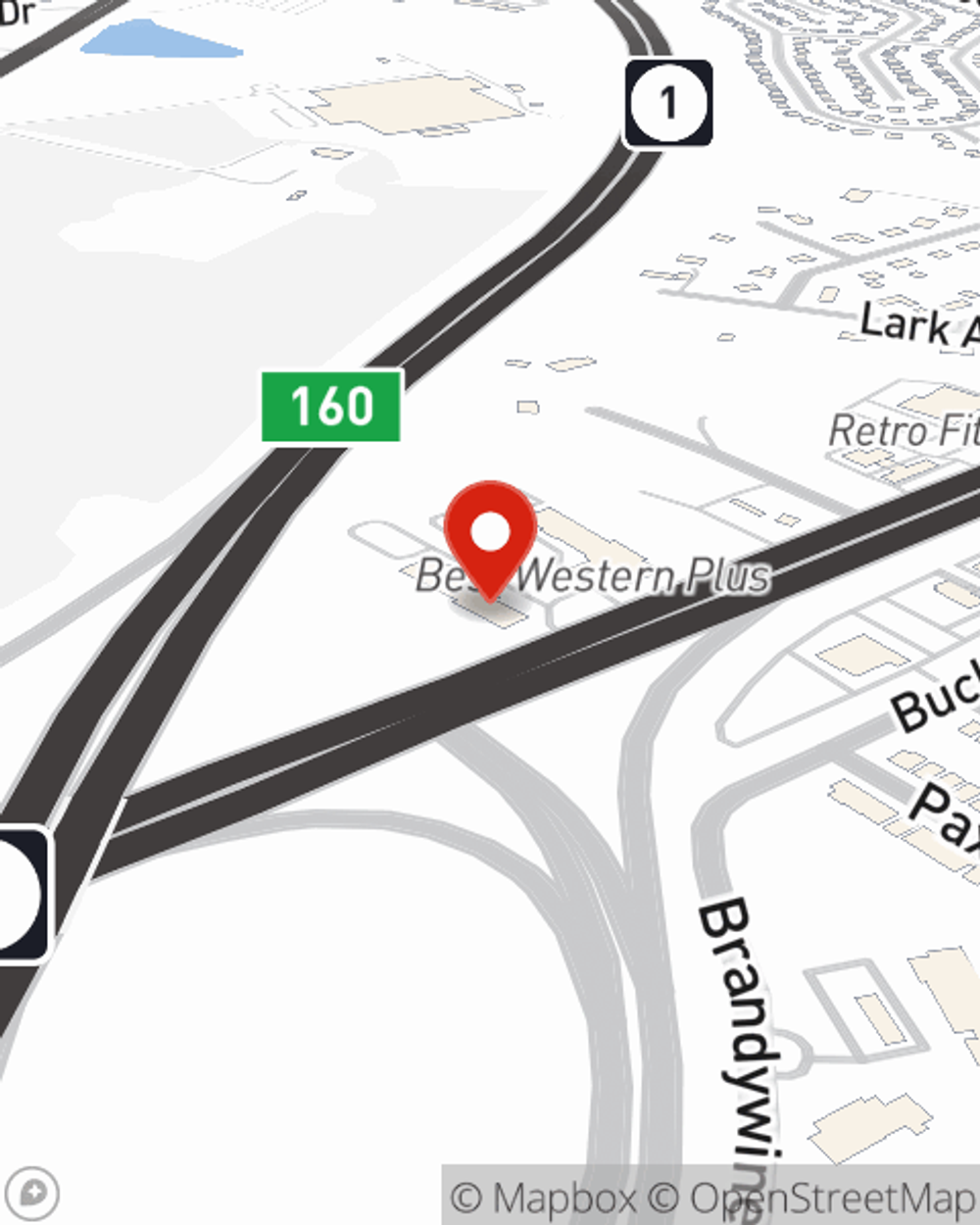

If you want to learn more, State Farm agent Rob Mullen is ready to help! Simply visit Rob Mullen today and say you are interested in this wonderful coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Rob at (302) 322-5331 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.